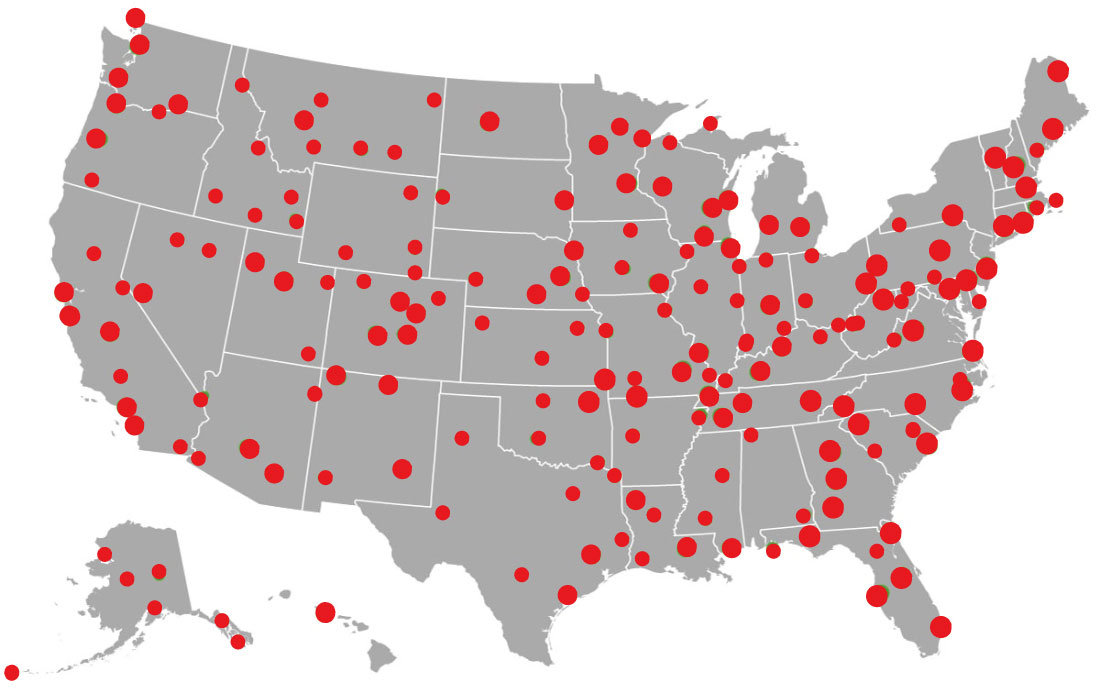

We are based in Alabama, but our cases take us all over the country. We work through the details, the causation, and the science needed to prove community toxic exposure. Depending on how complex your toxic exposure case is and to how many toxic agents you were exposed to, it can take several months to several years to obtain compensation, so finding the best legal assistance is crucial.

One way toxic exposure occurs is from contaminated products such as food and cosmetics. A relevant example in this respect is talcum powder, which is contaminated with asbestos. With regular use, the asbestos particles end up in the body and can trigger, over the years, a disease like cancer. If you wonder how toxic agents end up in consumer products, the answer is simple – negligence on the manufacturer's part. Another toxic product that has been receiving a lot of attention lately is baby food, which contains alarming concentrations of heavy metals. If you developed cancer or another disease as a consequence of using a product that was adulterated, we encourage you to contact our attorneys.

In addition to personal injury claims, our skilled lawyers also take on product liability claims. Therefore, if you have been using a product and developed a disease or had an accident, you can get in touch with us to recover the compensation you are entitled to. Negligent manufacturers must be held liable. This can happen only if more and more injured people come forward with evidence of the injuries caused by the defective products.